Notice of Hearing

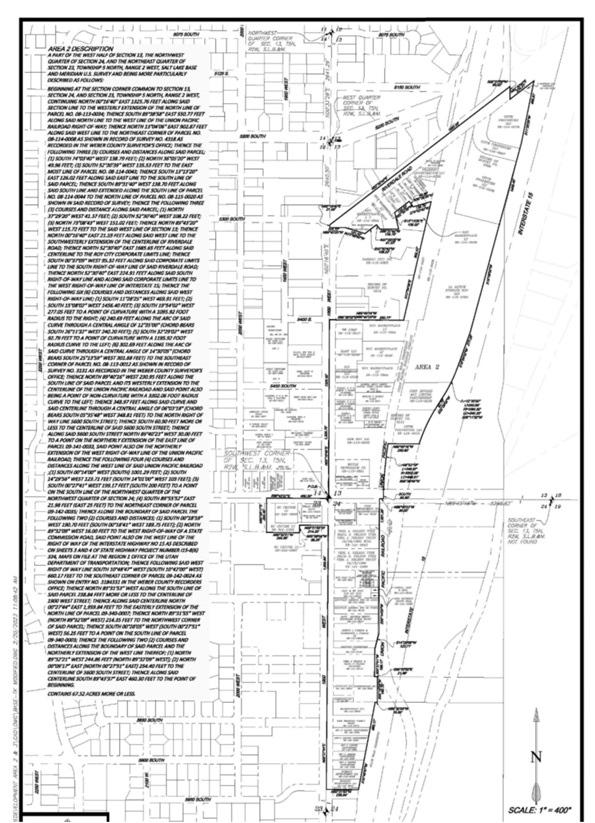

Amended 1900 Southeast Community Reinvestment Project Area

AMENDED 1900 SOUTHEAST COMMUNITY REINVESTMENT PROJECT AREA

On June 28, 2022 the Roy City Redevelopment Agency (the “Agency”), by resolution, adopted a Project Area Budget (the “CRA Budget”) for the Amended 1900 Southeast Community Reinvestment Area (the “CRA” or “Project Area”). Since its adoption, the Agency has negotiated the actual terms and conditions of the CRA, and the Agency now desires to adopt an amended CRA Budget (the “Draft Amended CRA Budget”) that accounts for these negotiated provisions.

The Agency has requested $24.92 million in property tax incremental revenues that will be generated by development within the CRA to fund a portion of the project development costs within the CRA. These property tax revenues will be used for the following:

Uses of Tax Increment

|

Uses |

Total |

NPV at 5.00% |

|

Redevelopment Activities (Infrastructure, Improvements, Incentives, etc.) |

$21,679,473 |

$12,274,479 |

|

CRA Housing Requirement (estimated @ 10%) |

2,491,893 |

1,410,860 |

|

Agency Administration (3%) |

747,568 |

423,258 |

|

Total Uses of Tax Increment Funds |

$24,918,935 |

$14,108,596 |

These property tax revenues are a result from an increase in valuation of property within the Project Area and will be paid to the Agency rather than to the taxing entity to which the tax revenue would otherwise have been paid if the taxing entities below agree to share the property tax increase under an interlocal agreement. The property taxes will be levied by the following governmental entities, and, assuming current tax rates, the taxes paid to the Agency for this CRA from each taxing entity will be as following:

Sources of Tax Increment Funds

|

Entity |

Total |

|

Weber County |

$4,989,498 |

|

Weber School District |

14,314,304 |

|

Roy City |

3,852,453 |

|

Weber Basin Water Conservancy District |

433,531 |

|

North Davis Sewer District |

1,214,925 |

|

Roy Water Conservancy District |

114,224 |

|

Total Sources of Tax Increment Funds |

$24,918,935 |

All of the property tax increment to be paid to the Agency for the development in the CRA are taxes that will be generated only if the CRA is developed.

The Draft Amended CRA Budget for the Project Area has been prepared and the Agency gives notice that a public hearing on the Draft Amended CRA Budget will be held on December 5, 2023 at 5:30 p.m., or as soon thereafter as feasible, at the Roy Municipal Building, 5051 S 1900 W, Roy, Utah (the “City Offices”). At the public hearing, the Agency will hear public comment on and objections, if any, to the Draft Amended CRA Budget, including whether the Draft Amended CRA Budget should be revised, approved, or rejected. The Agency will also receive all written objections, if any, to the Draft Amended CRA Budget. The Agency also invites public comments in support of the Draft Amended CRA Budget. All interested persons are invited to submit to the Agency comments on the Draft Amended CRA Budget before the date of the hearing. Any person objecting to the Draft Amended CRA Budget or contesting the regularity of any of the proceedings to adopt the Draft Amended CRA Budget may appear before the Agency’s governing board at the hearing to show cause why the Draft Amended CRA Budget should not be adopted.

Copies of the Draft Amended CRA Budget are available for inspection at the City Offices at 5051 S 1900 W, Roy, Utah during regular office hours. Any interested person wishing to meet and discuss the Draft Amended CRA Budget before the hearing may contact the Agency at the City Offices at (801) 774-1000 to set up an appointment. To schedule an appointment before the hearing, please call on or before November 21, 2023.

All concerned citizens are invited to attend the hearing on the Draft Amended CRA Budget scheduled for 5:30 p.m. on December 5, 2023 at the City Offices and/or to submit comments to the Agency before December 5, 2023, the date of the hearing.

In compliance with the Americans with Disabilities Act, the City and the Agency will make efforts to provide reasonable accommodations to disabled members of the public in accessing the public hearing. Please contact Brittany Fowers at bfowers@royutah.org at least 24 hours in advance of the meeting to request such accommodation.

Municipal Center Hours

Municipal Center Hours

City Manager: Matt Andrews, Assistant City Manager: Brody Flint, City Recorder: Brittany Fowers, City Attorney: Matt Wilson

City Manager: Matt Andrews, Assistant City Manager: Brody Flint, City Recorder: Brittany Fowers, City Attorney: Matt Wilson